529 Plans

- Starting in 2024, you can convert a 529 plan into a Roth IRA, for the 529 plan’s beneficiary, with no tax or penalty (restrictions do apply)

- 529 plan must have been in existence for ≥ 15 years

- Max of $35,000 per beneficiary over their lifetime. Conversions are limited to the Roth IRA contribution limit for that year

- Contributions and earnings from the last five years are ineligible

- Indiana 529 tax credit increased to $1,500 ($1,000 in 2022)

- Receive a 20% tax credit for every dollar contributed to an Indiana 529 plan up to $7,500 ($5,000 in 2022)

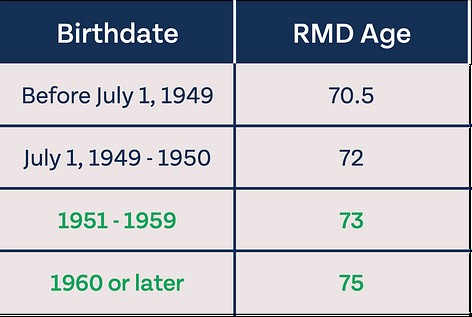

Required Minimum Distributions (RMDs)

- The IRS mandates distributions at a certain age from your pre-tax accounts. As of 2020 this was age 72. SECURE 2.0 updated the RMD ages to follow the table below.

Traditional IRA / Roth IRA:

- For 2023, the annual contribution limit increased to $6,500 ($6,000 in 2022)

- If 50 or older, the catch-up amount is still $1,000 for 2023

401k, 403b, 457, and Thrift Savings Plans:

- Your contribution limit has increased to $22,500 ($20,500 in 2022)

- If 50 or older, the catch-up amount is increased to $7,500 ($6,500 in 2022)

- The combined contribution limit (employee + employer) has increased to $66,000 ($61,000 in 2022)

Health Savings Accounts (HSA):

- Annual contribution limit increased to $3,850 ($3,650 in 2022) and $7,750 ($7,300 in 2022) for individual and family plans respectively.

- If 55 or older, the catch-up amount is still $1,000 for 2023

If you have questions about these or any of the updates in the new SECURE Act 2.0 you can visit our website at www.giesting financial.com or call one of our offices below. Our mission is to help you make wise financial decision so you can get the most out of life!

Batesville, Indiana – (812) 933-1791 Columbus, Indiana – (812) 565-2726

The information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

Batesville:

Batesville: